Are you looking for payroll software that can confidently tackle all your payroll-related tasks? Here comes a time when QuickBooks Payroll comes into the picture. Using the QuickBooks payroll, it has become more convenient to pay the employees on the same day and file the taxes on time. But, at times, users might stumble upon QuickBooks Payroll Error PS077 while downloading the latest payroll updates due to the old billing data.

You may also see the QuickBooks PS077 Payroll Error due to the inactive payroll subscription. Consequently, this error prevents the users from updating the tax table. Therefore, rectifying the error immediately is mandatory using the troubleshooting methods discussed below.

Wondering how to deal with the complicated QuickBooks Payroll Error PS077 alone? Contact us at +1-833-460-2030 and get the best possible solutions to figure out the issue quickly.

A Quick Introduction Of QuickBooks Error PS077

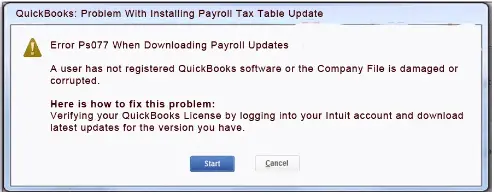

Usually, the users might come across QuickBooks Error PS077 while installing the most recent version of the payroll updates. On the appearance of the error, the users will be displayed the error message indicating:

“Error PS077 When Downloading Payroll Updates

A user has not registered QuickBooks software, or the Company File is damaged or corrupted”.

Other factors responsible for the error are inadequate, poor internet connection, or damaged company files. If you are also struggling with the same error, fix it easily using the troubleshooting methods discussed below.

Read More- QuickBooks Payroll Error PS038: How to Resolve and Prevent

What are the Reasons That Might Result in Error PS077 in QuickBooks?

It is important to find out the major causes that may trigger Error PS077 in QuickBooks so that you can resolve the issue smoothly. Therefore, we have elaborated on some root causes below to let you understand them properly.

- There might be the possibility that the QuickBooks company file you are using is either damaged or corrupt.

- You might be working on the QuickBooks Desktop version, which is not available anymore.

- Sometimes, it might trigger when you have listed the wrong billing details.

- In other cases, it may happen when you haven’t registered your QuickBooks software.

Resolve Error PS077: QuickBooks is having Trouble Installing Updates for Payroll Tax Tables Using These Simple Methods.

Herein, we have described all the best effective solutions to resolve Error PS077 in QuickBooks easily. Ensure that you follow the steps in the same manner as illustrated below.

Resolution Way 1: Cross-Check Your Billing Information

Most of the time, the users might end up with QB Payroll Error PS077 because of the wrong billing details. Therefore, it is essential to re-check that you have updated the billing details using the steps instructed below.

- First, launch your device’s QuickBooks Desktop and hit the F2 key to redirect you to the Product Information window.

- After that, besides the License Number, ensure you see the status as “Activated.”

- However, you must register your QuickBooks Desktop if it is not activated.

- Once the registration is completed successfully, you must update the QuickBooks Desktop to the most recently launched version.

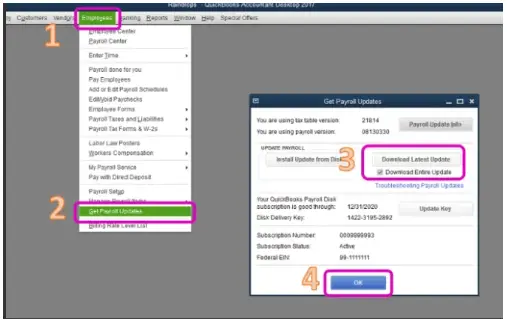

Resolution Way 2: Download the Latest QuickBooks Payroll Tax Table Update

You must follow the instructions below to download QuickBooks’s latest payroll tax table

- Initially, move to the QuickBooks Employees menu and choose the Get Payroll Updates option.

- Also, you must try resetting the QuickBooks update and then proceed further.

- Thereon, mark the checkbox next to the Download Entire Update option.

- Following this, choose the highlighted Download Latest Update option.

- Consequently, you will be displayed with a window telling you once the download is over.

Related article- Best Ways to Update QuickBooks Desktop to latest release

Resolution Way 3: Fix The Damage in Your QuickBooks Desktop Application

- To start the process, relaunch your device and shut down if any application obstructs QuickBooks.

- Afterwards, hit the Windows key and write Control Panel within the search panel.

- Once you reach the Control Panel window, select the Programs and Features.

- Thereon, if necessary, you must hit the Uninstall a Program option.

- In the next step, hit Uninstall/Change from the list of programs available to remove the QuickBooks application.

- Furthermore, hit the Continue tab followed by the Next button.

- You are supposed to click Repair > Next and then wait until the repair process is completed.

Summing It Up!!

Through this post’s help, we hope you can easily troubleshoot QuickBooks Payroll Error PS077. If you still have difficulty installing the latest payroll tax table update, connect with professionals at +1-833-460-2030 for quick resolution. They will listen to your query and offer you some useful tips to tackle the error quickly.

Frequently Asked Questions

Below are some points you must know before fixing QuickBooks Payroll Error PS077.

- In the first stage, you must confirm the validity of the QuickBooks payroll Subscription.

- Ensure that you are accessing the most currently launched version of QuickBooks Desktop.

- Also, confirm that the billing details mentioned in the payroll account are accurate.

To check which QuickBooks version you are currently using, launch the Product Information window using the F2 key. After that, in the upcoming screen, move to the File section, which will present you with the current QuickBooks version you are accessing.

The following are the signs and symptoms to help me decide whether I receive PS077 in QuickBooks Desktop.

- You might observe the poor performance of your operating system.

- The users might face difficulty while downloading the latest payroll updates.

- Users might also encounter issues downloading QuickBooks’s latest payroll tax table update.

The users need to take a backup of the QuickBooks data file; if anything happens with the data due to damage or corruption in the file, you can restore the data with the help of a backup file.

In order to verify your QuickBooks subscription status, log in to your QB account using the accurate login details. Thereon, navigate to the Settings > Account and Settings > Billing and Subscription. Soon after this, you will find your subscription status there.